Safeguard Your Path to Financial Recovery-- Contact Us Today for Personal Bankruptcy Discharge Suggestions

Safeguard Your Path to Financial Recovery-- Contact Us Today for Personal Bankruptcy Discharge Suggestions

Blog Article

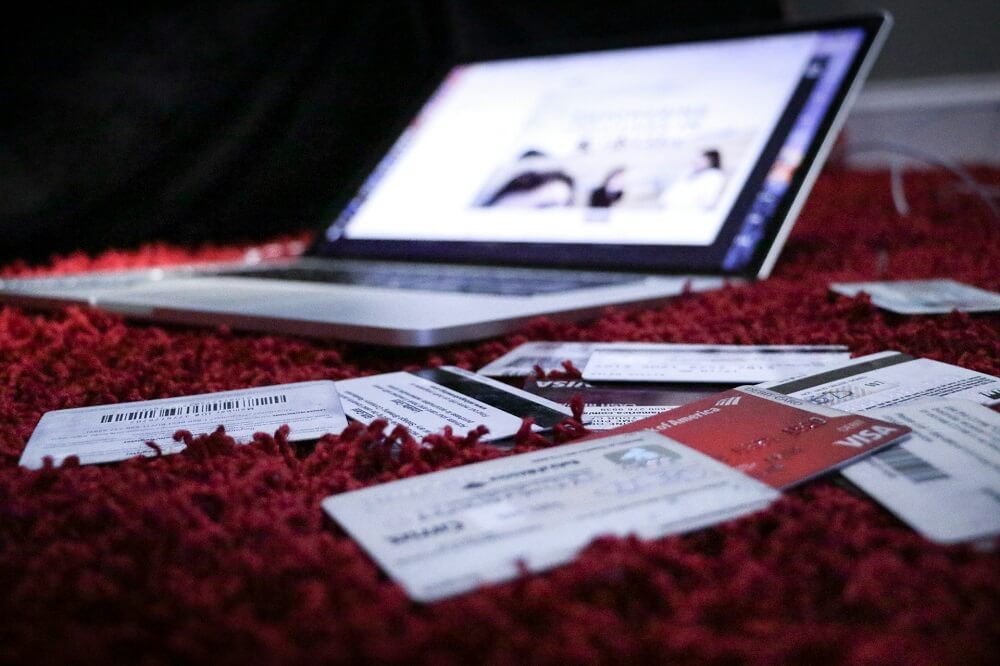

Unveiling the Possibility: Can Individuals Released From Insolvency Acquire Credit Rating Cards?

Understanding the Influence of Insolvency

Insolvency can have an extensive impact on one's credit history rating, making it testing to accessibility credit or loans in the future. This economic stain can linger on credit history records for numerous years, affecting the individual's capacity to secure favorable interest prices or monetary chances.

Factors Affecting Charge Card Approval

Obtaining a charge card post-bankruptcy rests upon numerous vital elements that considerably affect the approval process. One crucial element is the applicant's credit report score. Adhering to insolvency, people usually have a reduced credit history as a result of the adverse influence of the personal bankruptcy filing. Bank card firms commonly search for a credit scores rating that shows the candidate's capacity to handle credit score responsibly. An additional crucial factor to consider is the applicant's income. A steady income guarantees charge card providers of the individual's capability to make prompt payments. In addition, the length of time since the insolvency discharge plays a crucial duty. The longer the period post-discharge, the a lot more favorable the opportunities of authorization, as it suggests monetary security and accountable debt habits post-bankruptcy. Additionally, the sort of credit report card being used for and the provider's specific requirements can likewise affect authorization. By thoroughly considering these factors and taking steps to restore credit history post-bankruptcy, individuals can enhance their leads of obtaining a bank card and working towards financial recovery.

Actions to Restore Credit After Bankruptcy

Reconstructing credit scores after personal bankruptcy requires a calculated method focused on financial technique and regular financial obligation management. One reliable approach is to acquire a secured credit history card, where you deposit a particular amount as security to establish a credit report limitation. Furthermore, take into consideration becoming an authorized customer on a family participant's credit scores card or exploring credit-builder financings to more boost your credit history score.

Safe Vs. Unsecured Credit Cards

Adhering to personal bankruptcy, people often think about the option in between secured and unprotected credit rating cards as they intend to restore their creditworthiness and monetary security. Guaranteed debt cards call for a cash money deposit that serves as security, normally equal to the debt limitation approved. Inevitably, the selection between secured and unprotected credit rating cards need to line up with the person's monetary purposes and ability to take care of credit history responsibly.

Resources for Individuals Seeking Debt Rebuilding

For people aiming to improve their credit reliability post-bankruptcy, checking out available resources is crucial to efficiently visit their website navigating the credit history rebuilding procedure. One beneficial source for individuals seeking credit restoring is credit scores counseling agencies. These organizations offer financial education, budgeting aid, and personalized credit scores enhancement strategies. By dealing with a credit score therapist, individuals can get insights right into their debt reports, learn methods to increase their credit rating, and obtain guidance on managing their funds successfully.

An additional helpful source is credit score tracking services. These services allow individuals to maintain a close eye on their debt reports, track any type of adjustments or mistakes, and find possible indications of identification theft. description By checking their credit routinely, people can proactively address any kind of problems that might ensure and develop that their credit score information is up to date and accurate.

Moreover, online tools and sources such as credit report simulators, budgeting applications, and economic proficiency websites can offer people with valuable information and devices to help them in their credit rebuilding journey - contact us today. By leveraging these sources successfully, individuals released from bankruptcy can take significant steps in the direction of boosting their credit rating wellness and protecting a far better monetary future

Verdict

In verdict, people released from bankruptcy may have the opportunity to obtain credit score cards by taking steps to rebuild their credit rating. Variables such as credit rating income, background, and debt-to-income proportion play a significant role in bank card approval. By comprehending the effect of insolvency, picking in between safeguarded and unsafe credit score cards, and making use of sources for credit score rebuilding, people can enhance their creditworthiness and potentially obtain access to charge card.

Debt card firms typically look for a credit history rating that demonstrates the candidate's ability to manage credit properly. By meticulously considering useful reference these aspects and taking steps to restore credit scores post-bankruptcy, individuals can boost their leads of obtaining a credit score card and working in the direction of financial recuperation.

By functioning with a debt counselor, individuals can obtain insights right into their credit rating reports, learn methods to increase their credit ratings, and get assistance on managing their funds properly.

In final thought, people released from insolvency might have the opportunity to acquire credit rating cards by taking actions to rebuild their debt. By comprehending the impact of bankruptcy, choosing in between protected and unsecured credit scores cards, and making use of resources for credit history restoring, individuals can boost their creditworthiness and potentially get access to credit cards.

Report this page